What is Collision and Comprehensive Insurance?

Car insurance is a requirement to drive a car in Ontario. In addition to the parts of the policy that cover personal injury there are various provisions of the policy that provide compensation for damage to your vehicle, should that occur.

These provisions take into account:

The nature of the incident that resulted in the damage,

The degree to which that accident is your fault

The coverage available under your policy

The types of coverage which may compensate you for property damage to your vehicle are:

Direct Compensation- If you are involved in a collision with another vehicle, and the collision is not your fault, your own insurer will handle your property damage claim. They will pay to have your car repaired, provided the cost is less than the actual cash value of the vehicle at the time of the accident. If the repair costs more, you can expect to be paid the cash value of the vehicle.

Collision- Collision insurance covers damage to your vehicle if it is involved in a collision with an object other than another vehicle. It also covers you if you are in a collision caused by an unidentified vehicle. (This would be a “hit and run” type of accident). Collision also can cover your property damage if there is an accident for which you are deemed to be at fault. Usually, this coverage will be subject to a deductible. Making a claim under your collision coverage may also affect your premiums.

Comprehensive- This insurance is the coverage which is available in the event that your vehicle is damaged in an incident other that a motor vehicle accident. This would be theft, vandalism, fire, falling tree limbs, etc. It is also possible to purchase a more limited version of this coverage, depending on the details of your policy.

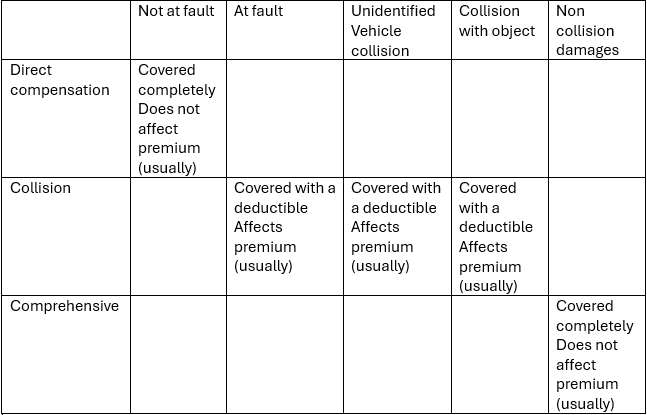

The chart below is a summary of which coverage would apply to which kind of accident. This is provided as a general guide to the coverages available. These elements of your policy should be discussed with your insurance professional to help you find the right coverage for you. There has to be a balance between the cost of insurance, the value of the vehicle or vehicles you have, and your own tolerance for the risk of damage to your vehicle.